Webinar on the Future of Cryptocurrency in India

Trade Promotion Council of India (TPCI), organised a webinar on The Future of Cryptocurrency in India 9th March 2022 (Wednesday). The panelists deliberated upon the growth of cryptocurrency in India and the implications of policy mechanisms being devised to regulate this sector.

Trade Promotion Council of India (TPCI), organized a webinar on The Future of Cryptocurrency in India 9th March 2022. The panelists from industry and academia discussed the growth of cryptocurrency in India and the implications of policy mechanisms being devised to regulate this sector.

Amidst the growing popularity of cryptocurrencies in India, regulators are worried about cryptocurrency being a secure medium for conducting transactions. For example, an Inter-Ministerial Committee (IMC) constituted to study the issues related to virtual currencies (2019) identified technical & regulatory risks associated with cryptocurrency. These include scalability and transaction speed; volatility; interoperability and integration; cyber security; data privacy; key management; governance; lack of maturity; lack of vetting standards, clarity about ownership and jurisdictions; customer due diligence requirements; and concerns regarding how transaction disputes or erroneous transactions can be resolved. The RBI, too, had expressed reservations about cryptocurrency in the past.

To address these concerns, the government is reportedly working on cryptocurrency regulation. The draft crypto bill defines cryptocurrency as “any information, code, or token which has a digital representation of value and has utility in a business activity, or acts as a store of value, or a unit of account.” The proposed legislation seeks to prohibit all private cryptocurrencies in India & to create a facilitative framework for the creation of the official digital currency to be issued by the Reserve Bank of India. However, it allows for certain exceptions to promote the underlying technology of cryptocurrency and its uses.

Another recent development is that the while India has decided to not recognise bitcoin as a legal tender, the 2022-23 Union Budget has proposed to impose a 30% tax on gains made on such trades, besides subjecting crypto transactions beyond a threshold to 1% TDS.

In context of the ongoing debate on whether crypto currency is a boon or a bane, this webinar analysed the implications of cryptocurrency for businesses & the economy and the possible contours that cryptocurrency regulation should now take.

The focus topics for the webinar were:

- The factors driving cryptocurrency’s global adoption

- Implications of cryptocurrency for businesses

- Why does cryptocurrency need to be regulated & what is the crypto bill?

- Industry’s take on the budget proposition of imposing tax on gains from crypto transactions

- India having an official digital currency and its implications

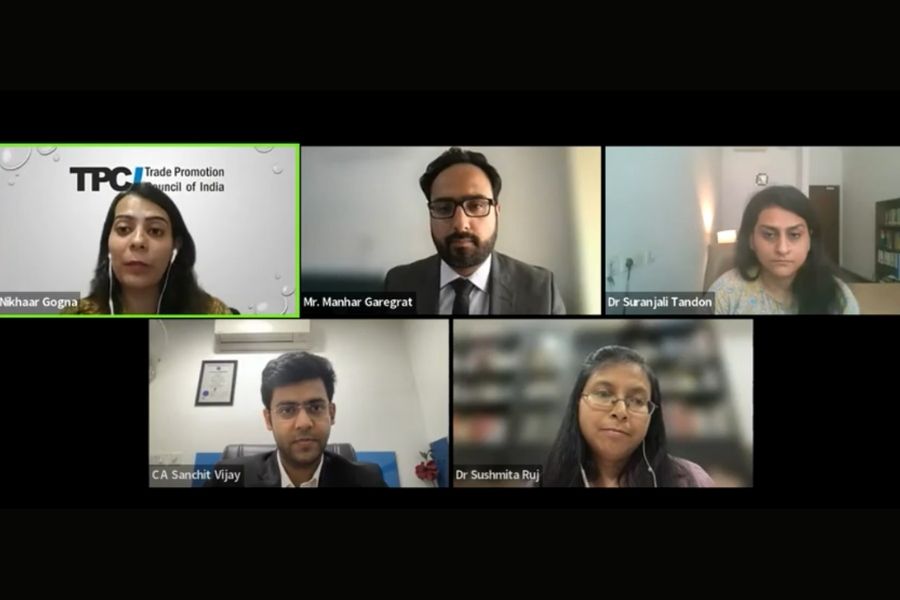

The speakers for the session were as follows:

- Mr Manhar Garegrat, Executive Director – Policy and Special Projects, CoinDCX

- Dr Sushmita Ruj, Senior Lecturer, School of Computer Science and Engineering, University of New South Wales, Sydney

- Sanchit Vijay, Partner – Deals & Valuations, Corporate Professionals

- Dr Suranjali Tandon, Assistant Professor, National Institute of Public Finance and Policy

The session was moderated by Ms Nikhaar Gogna.