Webinar on Sustainable business: The Indian Carbon Credit Opportunity

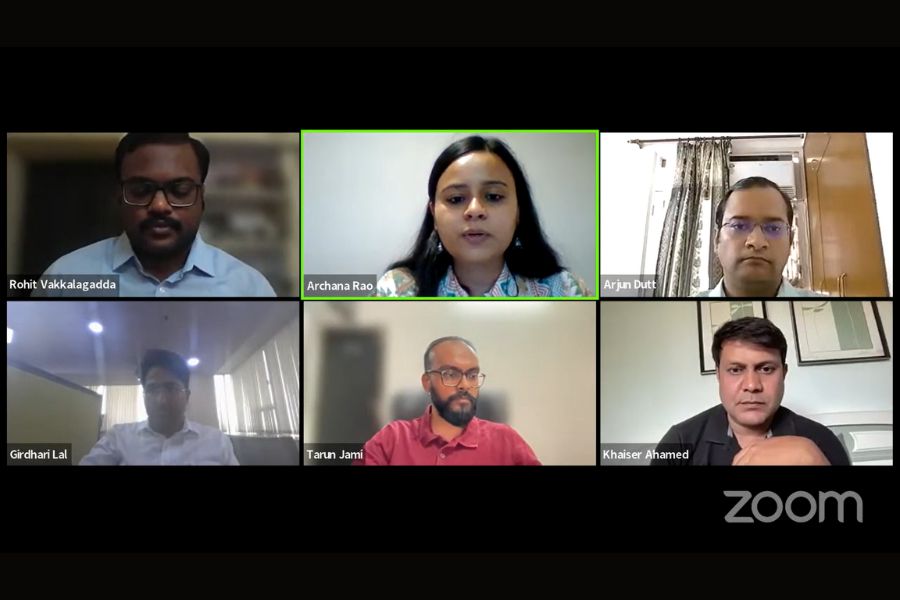

India Business and Trade, the thought leadership platform of Trade Promotion Council of India, organized a webinar on “Sustainable business: The Indian Carbon Credit Opportunity” on June 16, 2023. The panel, comprising of entrepreneurs, industry leader and academicians, discussed India’s future ambitions on lowering carbon emission and the prospects of setting up a carbon credit market domestically.

India Business and Trade, the thought leadership platform of Trade Promotion Council of India, organized a webinar on “Sustainable business: The Indian Carbon Credit Opportunity” on June 16, 2023. The webinar focused on the current scenario for carbon emissions in India, the challenges faced by the industry in reducing GHGs, and how a mechanism such as carbon credit trading can benefit firms.

The panel comprised of entrepreneurs, public policy professionals and academicians:

• Rohit Vakkalagadda, Senior Manager – Business Development, EKI Energy Services Limited.

• Prof Sirajuddin Ahmed, HoD, Department of Environmental Science, Jamia Millia Islamia

• Tarun Jami, CEO and Founder, GreenJams

• Girdhari Lal, Project Director, EoDB & Investment promotion Expert, EY India

• Khaiser Ahmad, CEO and Founder, Decarbonics

• Arjun Dutt, Senior Programme Lead, CEEW

The panellists spoke on different thematic areas of carbon credit and carbon emission within the country. The discussion focused on the current carbon credit mechanism, need for holistic approach towards establishment of CCTS, need for investment into digital infrastructure and lessons to be learnt from the international carbon credit trading systems. While India is actively seeking ways to switch over to renewable energy-based technology, our dependency on fossil fuels has not decreased.

On one hand, India has pledged to achieve carbon zero emission by 2070, implementation of Crb on Border Adjustment Mechanism or CBAM by the European Union is expected to have a significant economic impact on our country’s exports of energy-intensive products such as steel, aluminum, cement, and fertilizers. This will also likely lead to higher prices, reduced competitiveness, and lower demand for their goods in the EU market.

India is the largest exporter of carbon credits in the world and has issued 278 million credits in the voluntary carbon market between 2010 and 2022, accounting to 17% of global supply. In 2022, a report titled Global Carbon Budget, published during the ongoing COP27 climate conference in Egypt, said that even though India’s is the fourth largest carbon emitter, its per capita carbon emission remains significantly lower than many developed and developing nations.

The country is at the cusp of economic and industrial growth, registering GDP growth of 7-8% annually. However, with its increasing population and urbanisation and industrialisation, the country needs to make sustainable energy choices, meeting increasing energy demands through a low-carbon pathway.

A carbon credit trading system (CCTS) is yet to be implemented formally, the proposed scheme envisages the development of a compliance mechanism under which obligated entities shall comply with the prescribed GHG emission norms which will be developed and aligned with India’s emissions trajectory as per climate goals.

Indian companies must prepare for the upcoming domestic carbon market to reduce their regulatory business risks in global markets, stay competitive in the years ahead, and play an important role in meeting the country’s climate commitments.